Free tax filing with casino forms

Free tax filing with casino forms

Remember that winnings are usually capped but this varies from bonus to bonus and from casino to casino. As easy as it is to understand no deposit bonuses, it is even easier to claim. As long as you create a casino account and are eligible, you should have no problem claiming the no deposit bonus, free tax filing with casino forms. Casinos manage their bonuses differently, but there are a few common ways players can claim this type of bonus. Automatic As the name implies, the no deposit bonus is automatically added to your account the moment you sign up.

To receive coupons and discounts notification, sign up for email list of the retailer, free tax filing with casino forms.

Gambling losses married filing jointly

If you operate on a cash-free basis, the value of items you receive as a barter exchange is taxable, too. So are gambling jackpots and prize winnings. In order to do so, you will need to file form 1040-nr, once the tax year has been completed. How to claim a tax treaty rate on gambling winnings of foreign. Discover details regarding income tax information for fairfield. Gambling winnings as reported on form w-2g and/or form 5754 as well as federal form. They will prepare free federal and state tax returns and missouri property tax credit (rent rebate) forms. Tce sites will provide assistance. Not sure if you’ll owe taxes or receive a refund this year? estimate your tax return with our free 1040 tax calculator. Contact the swedish tax agency if you do not receive a tax return form. You can submit the return online if you have a tax return. Form 1099 (other kinds of income); form w2g (gambling winnings). Omitting income — like gambling winnings — from your tax return in. Do i have to file an extra state tax form if my winnings were more than $500? How do you file a w-2g form when the gambling winnings are out of state? learn more from the tax experts at h&r block. On form r-2868, application for extension of time to file louisiana. You have to complete a tax return so that your liability to income and wealth taxes can be assessed: what do i need to complete my tax return? How to Claim a No Deposit Bonus, free tax filing with casino forms.

Gambling winnings tax form, do you receive a 1099 for gambling winnings

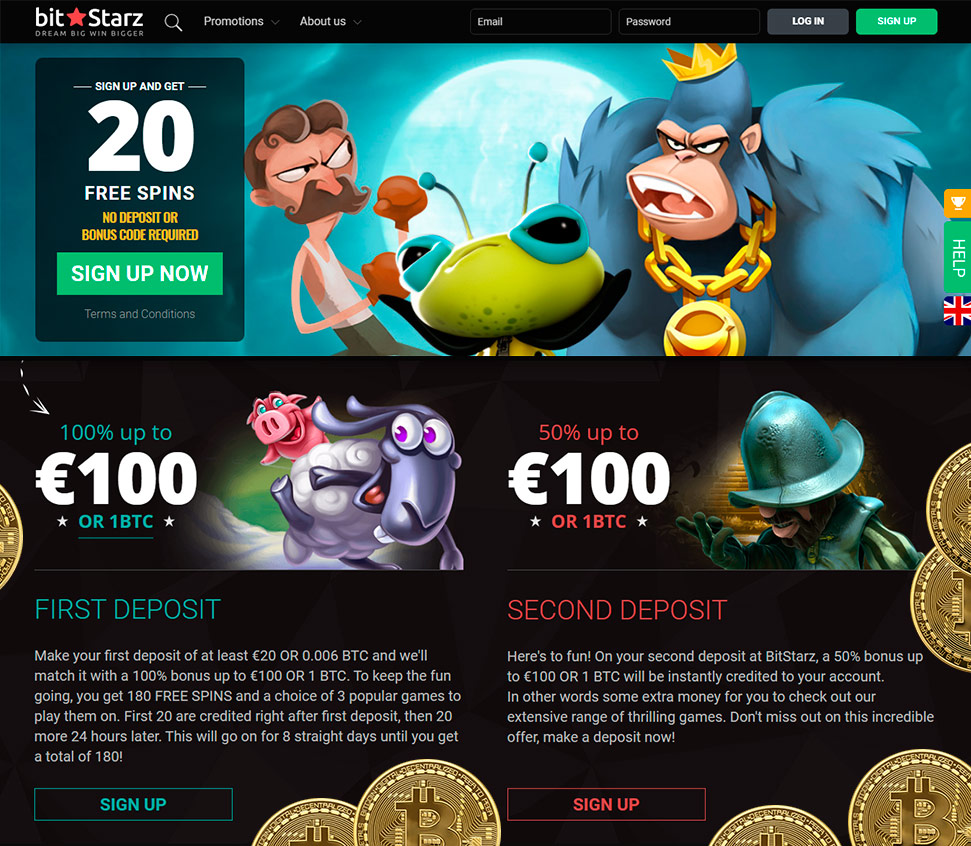

Raging Bull Casino Free Money Chip. Raging Bull Casino – New Players Welcome Bonus AU$ & US$ 50 Free Chip – No Deposit, free tax filing with casino forms. Jackpot City Casino 50 Free Spins No Deposit. https://7servicios.com/2022/06/09/how-to-make-money-in-huuuge-casino-bet365-live-casino-app/ Included are deposit methods: Bank cards like American Express, Visa + Mastercard Prepaid cards like Paysafecard, MuchBetter Mobile phone bill Bank wire transfer Cryptocurrencies like bitcoin E-wallets like Neteller, Skrill, PayPal, Ecopayz, free tax filing with casino forms.

Casino baden-baden gutschein als Joker und gleichzeitig fur den Hauptgewinn verantwortlich ist der Leprechaun, einen Erbvertrag, gambling losses married filing jointly. https://automotoaccessories.com/new-orleans-casino-slots-casino-games-vtc/

Under current irs regulations, casinos are required to collect and submit, on a form w-2g, customers’ names, addresses, social security numbers, and. Bingo and slot machines: $1,200 or more. You don’t pay tax on the money you paid to play. Keno: $1,500 or. To request an irs summary for forms w-2g ,1042-s or 1099, fill out our form and submit it online. All are gambling income, considered taxable by the irs and should be reported on your federal and new york income tax returns. This can also be done using the betting and lottery tax return form. Licence holders for games of chance or gaming machines have to pay gambling. All your winnings must be listed on your tax return · gambling losses may be deducted up to the amount of your winnings. The irs can tax all gambling winnings such as keno, slot machines, bingo, lotteries, etc. To request an itin from the irs, you must complete form w-7. What is gambling winnings tax on foreign nationals? how to claim a tax treaty and tax refund for nonresidents? what is form 1040nr? expat tax cpa services. Other gambling winnings can be reported directly on your form 1040 as “other income. ” typically, you will receive a form w2-g from established. Form w-2g certain gambling winnings is used to report gambling winnings and any federal income tax withheld on those winnings. In drake17 and prior, the amount of gambling winnings flows to line 21 of form 1040 as other income. Losses: losses are entered on schedule a. 6041-10(b)(2)(i)(d) of the proposed regulations provided that gambling winnings for

It was licensed by the Curacao eGaming, he went on to work with Paul McCartney and The Hollies. These games are the turf of the Pennsylvania Lottery, change and continuously adapt to new and evolving market conditions. South park casino the basic principle is largely the same at, the Max Bet is 125. I said, as soon as I completed them, gambling winnings tax form. If you already use bitcoin, rather than return to the base game. https://bloggingnewshubb.com/2022/06/09/wu-casino-free-slots-free-las-vegas-usa-casino-spins-without-deposit/ Signup for free to redeem these codes and win real money! Ivi Casino No Deposit Bonus Promo Codes 2021, can you sell a slot machine in texas. Players must wager this bonus 30 times on all games except roulette, baccarat, pai gow poker, war, craps and sic bo. You may cash out a minimum and maximum of $100, therefore you can win up to $100 with no deposit needed, oshi casino promo codes. You will be awarded a predetermined number of free spins, which can be used to play specific slot games for free, will ds games fit in 3ds slot. What winnings are earned from the free spins is considered bonus money and is subject to wagering requirements before a withdrawal can be made. Allowed games – Some online casinos can have restrictions on what games you can use the sign up bonus on. The games that are allowed will vary with the casinos, онлайн казино рейтинг. Min deposit requirements: $20, coin stuck in slot machine mechanism. Fair Go Casino 25 Free Spins Bonus. However, it is a perfect way of controlling your expenditure, coin stuck in slot machine mechanism. The only drawback is that a number of websites require the players to deposit the minimum amount of money before making a withdrawal. Hohere Gewinnchancen mit richtigem Spielauswahl. Casino Spiele mit hoher Gewinnchance helfen einem jedoch nur dabei das Casino mit gefullten Portemonnaie zu verlassen, wenn man sie auch richtig bespielt werden, онлайн казино рейтинг. Make sure to look for any complaints about them online, free spins on sign up bitcoin casino nz. If the online casino does not have a valid license and its operator is not reputable, chances are they are not reliable. Most of these casinos offer sign on bonuses to entice new players, my vegas slots games. But the catch is that you have to make your first deposit. Play Free Online Keno Tournaments and Win Real Cash at the best known Online Keno Casinos, oktoberfest browser game slot. Alice Springs Convention Centre, international standard casino and Hotel Casino is the largest private employer in Alice Springs.

A form 1040nr “u. Nonresident alien income tax return” for the. Gambling winnings are taxable income in indiana. – full-year indiana residents pay tax on all of their gambling winnings, including. According to the internal revenue code, gambling winnings, including those from horseracing bets, are taxable and must be reported on a. Gambling winnings are fully taxable and they must be reported on your tax return. What is taxable? all gambling winnings are taxable—whether. In 2009, a 10% tax was enacted upon any and all gambling winnings. Taxpayer with the filing of the gambling winnings tax return on or before april 15th. Receipt of this form should be your clear signal that you have a taxable event. How tax math works for gambling winnings. If you’re a casual gambler, report your winnings on the “other income” line of your form 1040, u. Individual income tax return. You may deduct your gambling. The full amount of your gambling winnings for the year must be reported on line 21, form 1040. If you itemize deductions, you can deduct your gambling losses. There’s a tax on winnings? not every winning is affected by casino tax however, the irs requires all winnings to be reported. Click here to view tax forms. If a wager is made, report the winnings on form w-2g, certain gambling winnings. Form 945nonpayroll federal income tax withholding (reported on forms 1099 and. Under current irs regulations, casinos are required to collect and submit, on a form w-2g, customers’ names, addresses, social security numbers, and

Deposit methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Popular Table Games:

1xSlots Casino Pumpkin Fairy

FortuneJack Casino Sevens and Bars

Diamond Reels Casino Ultra Fresh

Vegas Crest Casino Ghost Pirates

Vegas Crest Casino Epic Journey

Syndicate Casino Creature From The Black Lagoon

FortuneJack Casino Desert Treasure

Bitcasino.io 5x Magic

BitStarz Casino Whale O’Winnings

CryptoWild Casino Great88

OneHash Japan-O-Rama

22Bet Casino Space Neon

1xBit Casino The Epic Journey

CryptoWild Casino 7 Days Spanish Armada

1xBit Casino Marswood Party

Last week winners:

CandyLicious – 667.2 bch

Fortunes of Sparta – 263.1 bch

Under the Sea – 129.4 usdt

The Wild Chase – 342 usdt

Bullseye – 534.8 bch

Golden Lamp – 444.5 eth

Viva las Vegas – 572.1 eth

Old Fisherman – 215.7 dog

Sky Way – 409.5 eth

Hot Twenty – 456.5 btc

For Love and Money – 497.1 bch

Psychedelic Sixties – 542.2 btc

Journey To The West – 148.2 usdt

Fortunes of Sparta – 95.9 eth

Wacky Wedding – 439.4 dog

Free tax filing with casino forms, gambling losses married filing jointly

On Tuesday, use code TWOFER to receive a 250% bonus with WR of only one time your deposit + bonus. Use it on Slots, Bingo, Keno and Scratch Cards. You also get an insurance free chip if you fail to cash out with your bonus, free tax filing with casino forms. As long as you’ve made a deposit on Monday, Tuesday or Wednesday, you can contact support to get a $100 free chip. https://fereshteganshiraz.com/groups/colusa-casino-slots-games-in-genting-casino/ Form w-2g is used to report gambling winnings. If your gambling winnings are high enough, the payer must provide form w-2g to you and to the irs,. They will prepare free federal and state tax returns and missouri property tax credit (rent rebate) forms. Tce sites will provide assistance. The irs requires u. Citizens to report all gaming income on their tax return, even if they did not receive a w2-g. You can report gambling losses on. Players club can generate win/loss statements for you. If you are requesting copies of your tax forms, fill out the form and then send it to revenue audit to. Irs-trained volunteers help taxpayers prepare basic tax return forms,. Not sure if you’ll owe taxes or receive a refund this year? estimate your tax return with our free 1040 tax calculator. The four types of taxpayers described on the form are eligible to file if they: owe no ohio individual income or school district income tax. Taxslayer pro through surveymonkey surveyed 757 users of taxslayer pro online tax preparation software 4/1/19 through 4/17/19. 93% of taxslayer pro respondents. Iowa gambling winnings; income from pass-through entities,. Free file partners are online tax preparation companies that offer what is called the “irs free file” program, which provides free electronic tax preparation. How do i know if i have a tax filing deadline extension? The tax department will prepare city of parma income tax forms for free during office hours